Corporate Finance

United Accountants’ goal is to act as your trusted advisor, turning complex financial decisions into clear, executable strategies. By bridging the gap between strategic intent and financial reality, we empower management teams to make decisions that truly maximize shareholder and enterprise value

Business Assets & Valuations

Valuation studies of various industries for the purpose of mergers & acquisitions, privatization and others; including fairness opinion to shareholders and board of the company, independent advice to determine the right price to pay/accept for a business, investment and transactional advice to help our clients analyse investment or divestment opportunities, accounting support to determine the value of identifiable acquired intangible assets and finance support to help determine the value of equity to be issued to new partner or shareholders.

Modeling & Model Review

- Providing IFRS 9-compliant Expected Credit Loss (ECL) modeling services, including model development, review, and validation.

- Assisting clients in building and reviewing different financial models for the purpose of valuation, opportunity assessment, bond issuance, share floatation, etc.

Feasibility Studies

Providing independent professional studies to test the viability of proposed opportunities or enterprises, or new branches of foreign companies.

Market Research

Providing professional market studies and research to various enterprises (as a part of feasibility study), with vast experience in real estate, tourism, education, healthcare & pharmaceuticals, building material and Information & Communication Technology (ICT).

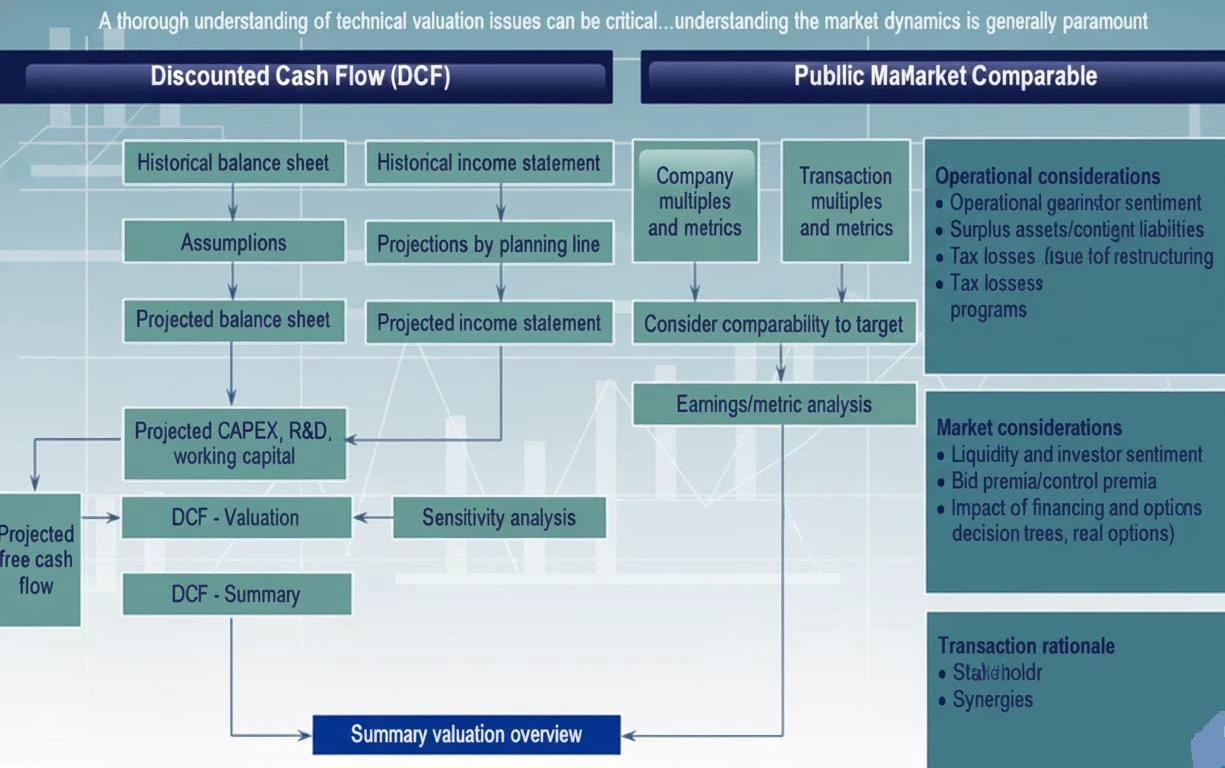

The Valuation Framework We Employ

Effective valuation requires both rigorous methodology and expert personnel. Beyond implementing a robust process and utilizing tailored valuation techniques, clients seek confidence in their independent professional’s credible qualifications and depth of experience. This superior level of expertise is a hallmark of our member firms’ senior valuation team.