Auditing

• Our approach to deliver an effective audit require from us

to plan ahead before we start any audit engagement. In

order to do that we need to understand your business as

thoroughly as possible so we can advice you properly.

• We believe that each audit assignment is unique, we

design a specific audit plan and program that are tailored to

meet the unique nature of our client’s business and

operating environment focusing on the highly risk areas

that might affect the business.

Audit objectives

Is to issue audit report with opinion whether financial statements are free of material misstatements prepared in accordance to Egyptian accounting standards .

Our scope and responsibilities of work in audit assignment will include the following:-

Our responsibilities in accordance to Egyptian auditing standards can be defined in audit assignment as providing opinion whether financial statements are presented fairly in all material aspects in conformity with Egyptian accounting standards, accordingly we provide reasonable but not absolute assurance that financial statements are free of material misstatement .

Audit also include determination of material misstatements arise through audit and communicate it to governance board (your B.O.D) this include discussion and communication to management on timely basis to correct material misstatements.

• For providing such opinion we will examine on test basis evidences support amounts and -Disclosures, assessing appropriateness of accounting principles ,assessing significant estimate made by management as well as assessing fair presentation of financial statements ,and accordingly we will inspect documents ,accounting records, minutes of board of directors and confirm balances with third parties when required.

• Will supervise physical count or physical inspection of fixed assets, and confirm balances with third parties as necessary and described by Egyptian auditing standards and we will use procedures permitted by audit standards as inspection ,inquiries ,analytical procedures, vouching ,tracing and any other procedures necessary to fulfill our objectives.

Auditing

• We will obtain letter of your legal counsel or your attorney in regard of claims litigation and we might inspect and make correspondence with any regulatory agencies as necessary to assess adequacy of provisions and disclosures.

• As governance is the responsibilities of management, we will assess whether governance -Policies and procedures including risk assessment policies and procedures are effectively applied, to Determine whether it is confirmed with management responsibilities and whether management comply or not .

• We will obtain representation letter as required by Egyptian auditing standards in which management will acknowledge its responsibilities in regard to completeness of your data and its responsibilities of preparation of financial statements, compliance with laws and Maintain effective internal control and acknowledge other areas that we might think that we need additional evidences surround it.

• We will issue statutory audit report that describe management responsibilities, our Responsibilities, scope, and opinion on financial statement.

Auditing

• We might obtain full description of name, type of relation and volume of transactions incurred by those defined as related parties and in some cases we might find it necessary to confirm balances .

• Attend general assembly meeting and respond to shareholders inquiries in regard to financial statements.

• We might assist in fulfilling requirements of law (159) for the year 1981 of approvals.

• We might ask your permission for contacting predecessor auditor (If that applies) for analysis of beginning balances and to discuss comparative figures ,also we will contact him under matters as described in Egyptian audit standards.

• In case of any going concern problems or doubts ,it is the company responsibilities to prepare a plan that eliminate that doubt and our main responsibilities to assess the adequacy of plan and convince that it will be achieved and evaluate adequacy of disclosures.

• To disclose circumstances in which fraud was detected to the appropriate level of management or B.O.D

Audit limitation

Audit include risk as described by Egyptian audit standards that misstatement may remain undetected under certain circumstances and our responsibility is to decrease this risk to the appropriate level and apply professional due care .

• Other issues

○ We will hold meeting as necessary with your management upon adequate notification to discuss in our audit findings, report and our internal control management letter.

○ We will provide notice prior to our audit and send you audit requirements list to be prepared.

○ We will receive and respond to your management inquiries in regard to application of principals and tax law without any implementation rule that make us impair our independence.

○ We will have to arrange meeting upon our contract to determine deadlines and time schedules of services.

• Other issues

○ We would appreciate cooperation with your financial department personnel, internal auditor that we may use his reports or works (if any).

○ We might use specialist in case of specific kinds of projects or inventory need especial knowledge that beyond our audit, in that case we will notify you about our need to cooperate with specialist that you appoint or otherwise appointed or recommended by us.

○ In case of any going concern problems or doubts ,it is the company responsibilities to prepare a plan that eliminate that doubt and our main responsibilities to assess the adequacy of plan and convince that it will be achieved and evaluate adequacy of disclosures.

○ To disclose circumstances in which fraud was detected to the appropriate level of management or B.O.D

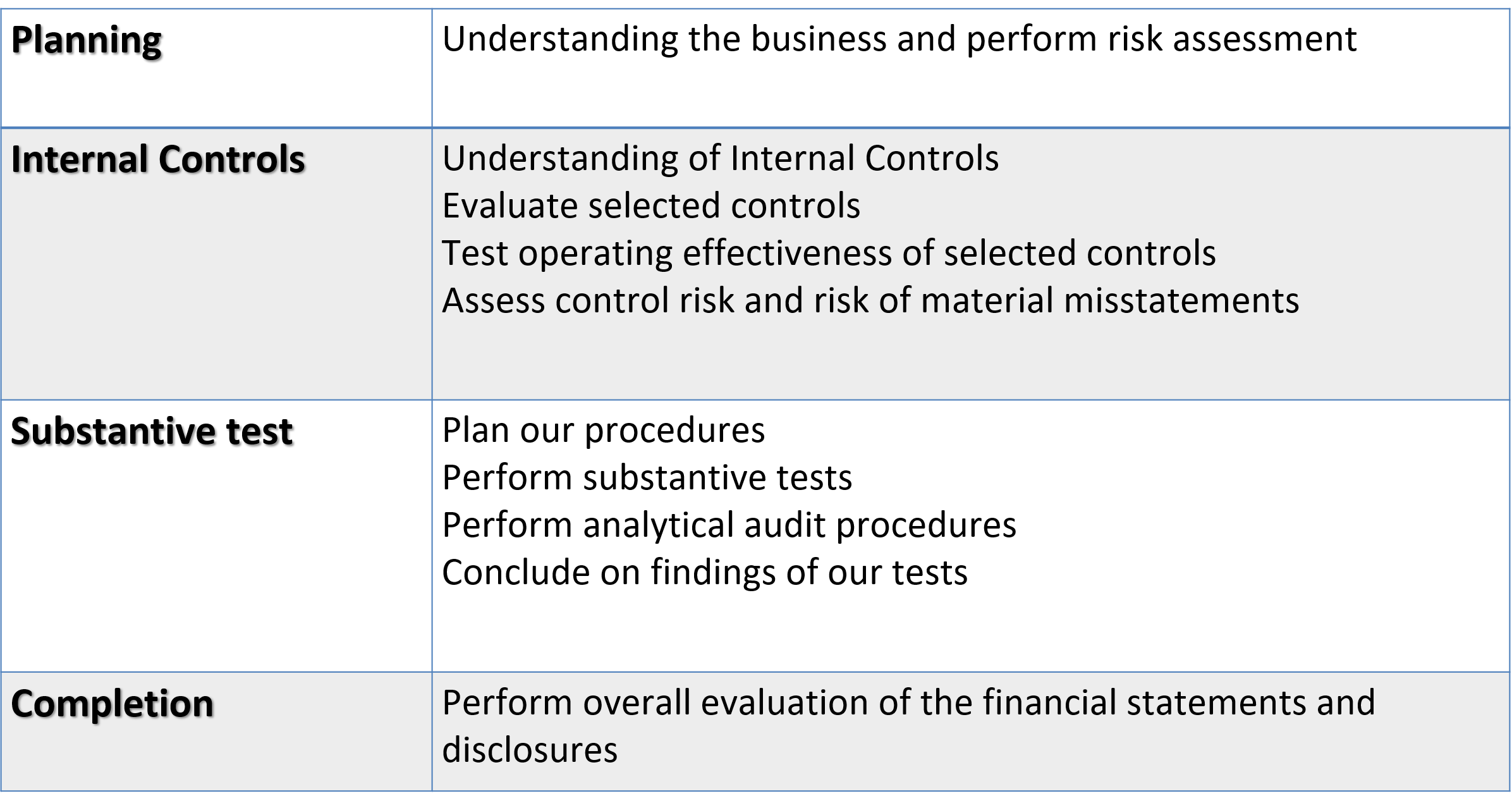

OUR METHODOLOGY

List of the services and the rule of each function

Audit of the Company’s annual financial statements for the year ended December 31, 2022 which prepared in accordance with Egyptian Accounting Standards and with the requirements of the related applicable Egyptian laws and regulations, in order to express a fair opinion on whether the Company's financial statements represent fairly , in all material respect, the financial position, results of operation and cash flows.

Review of the Company’s quarterly financial statements for March, June, and September 2022 “If requested "which prepared in accordance with Egyptian Accounting Standers and with the requirements of the related applicable Egyptian laws and regulations, in order to express a negative assurance that nothing came to our attention that the Company's financial statements does not represent fairly , in all material respect, the financial position, results of operation and cash flows.

OUR AUDIT APPROACH

Timeline

We intended to issue our reports on the financial statements of the Company on a mutually agreement upon date. We understand that all records, documentation and information we request in conjunction with our audit will be made available for us.

• Milestone

○ During the year, and before starting our interim audit, we will discuss the audit issues, time frame and may use a hard close technique in order to meet the due date requirements.

○ Audit requirements will be sent to the Company enough time before end of the year.

○ Meet with management before year end in order to discuss planned timeline for issuing the financial statements and our reports.

• Audit and review reports

At the conclusion of our audit, we will express an opinion as to whether the Company’s financial statements fairly present (negative assurance for the quarterly FS) the financial position, results of operations and cash flow information of the Company, in conformity with the Accounting Standards and in the light of related and applicable Egyptian laws and regulations.

• Management letter

During the course of our audit, matters may come to our attention related to weaknesses in internal control or areas where it may be possible to improve the efficiency or effectiveness of your operations. We will report any such matters of significant to you in the form of a management letter.

We are not required by auditing standards to make an examination of internal controls beyond that which we make in determining the nature, extent and timing of our audit procedures.

Call now to get our special services

Be a part of our wonderful customers, we will be a part of your success